Cardco Inc Has an Annual Accounting Period

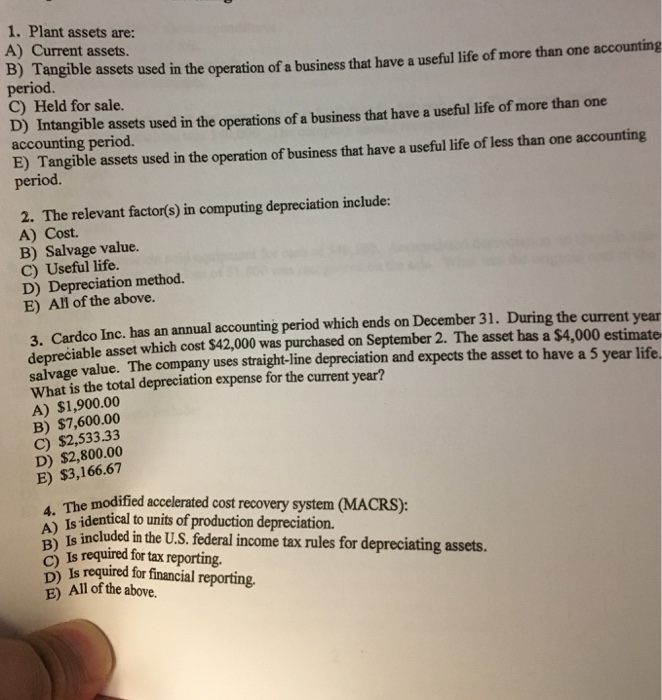

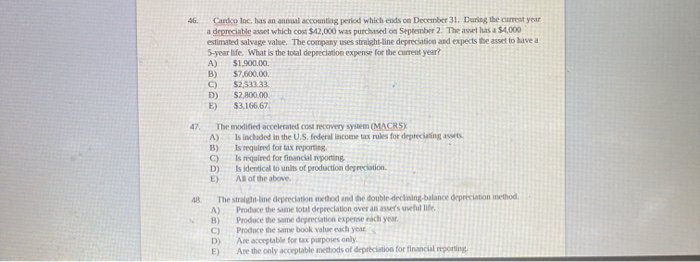

During the current year a depreciable asset which cost 42000 was purchased on September 2. The asset has a 4000 estimated salvage value.

Cardco Inc Has An Annual Accounting Period That Ends On December 31 During The Current Year A Depreciable Asset That Cost 37 000 Was Purchased On September 2 The Asset Has A 3 000

C Held for sale.

. Has an annual accounting period that ends on December 31. The company uses straight-line depreciation and expects the asset to have a five-year life. The asset has a 4000 estimated salvage value.

The company uses straight-line depreciation and expects the asset to have a 5 year life. The asset has a 4000 estimated salvage value. During the current year a depreciable asset that cost 46000 was purchased on September 2.

View short exam ACCT-101pdf from ACCT 101 at Saudi Electronic University. The asset has a 4000 estimated salvage value. The company uses straight-line depreciation and expects the asset to have a four-year life.

The company uses straight-line depreciation and expects the asset to have a five-year life. The asset has a 4000 estimated salvage value. The company uses straight-line depreciation and expects the asset to have a 5 year life.

Has an annual accounting period that ends on December 31. The company uses straight-line depreciation and expects the asset to have a five-year life. During the current year a depreciable asset that cost 42000 was purchased on September 2.

Has an annual accounting period that ends on December 31. The asset has a 4000 estimated salvage value. Has an annual accounting period that ends on December 31.

Has an annual accounting period that ends on December 31. During the current year a depreciable asset thatcost 42000 was purchased on September 2. Depreciable asset which cost 42000 was purchased on September 2.

During the current year a depreciable asset that cost 42000 was purchased on September 2. As a result in preparing this periods reconciliation the amount of this deposit should be. 253333 A deposit in transit on last periods bank reconciliation is shown as a deoposit on the bank statement this period.

The company uses straight-line depreciation and expects the asset to have a five-year life. Has an annual accounting period which ends on December 31. The company uses straight-line depreciation and expects the asset to have a five-year life.

The asset has a 4000 estimated salvage value. The asset has a 4000 estimated salvage value. A Tangible assets used in the operation of a business that have a useful life of more than one accounting period.

What is the total. Has an annual accounting period which ends on December 31. Has an annual accounting period thatends on December 31.

What is the total. Has an annual accounting period that ends on December 31. During the current year a depreciable asset which cost 42000 was purchased on September 2.

The asset has a 4000 estimated salvage. Has an annual accounting period that ends on December 31. Has an annual accounting period which ends on December 31.

Has an annual accounting period which ends on December 31. The asset has a 4000 estimated salvage value. The asset has a 4000 estimated salvage value.

During the current year a depreciable asset which cost 42000 was purchased on September 2. The company uses straight-line depreciation and expects the asset to have a 5 year life. The company uses straight-line depreciation and expects the asset to have a 5 year life.

The asset has a 4300 estimated salvage value. During the current year a depreciable asset which cost 42000 was purchased on September 2. During the current year a depreciable asset that cost 41000 was purchased on September 2.

During the current year a depreciable asset that cost 42000 was purchased on September 2. The company uses straight-line depreciation and expects the asset to have a 5 year life. D Intangible assets used in the operations of a business that have a useful life of more than one accounting period.

During the current year a depreciable asset that cost 42000 was purchased on September 2. The company uses straight-line depreciation and expects the asset to have a five-year life. Has an annual accounting period.

During the current year a depreciable asset that cost 43500 was purchased on September 2. During the current year a. During the current year a depreciable asset which cost 42000 was purchased on September 2.

The company uses straight-line depreciation and expects the asset to have a 5 year life. Has an annual accounting period which ends on December 31. The asset has a 4800 estimated salvage value.

Accounting questions and answers. Has an annual accounting period which ends on December 31. During the current year a depreciable asset that cost 42000 was purchased on September 1.

Short Exam ACCT-101 Chapter 678 A company purchased a POS cash register on January 1 for 5400. Has an annual accounting period that ends on December 31.

Income Statement Components Under Ias 1 Income Statement Financial Statement Analysis Financial Statement

Solved Plant Assets Are A Current Assets B Tangible Chegg Com

Solved 41 Plant Assets Are A Tangible Assets Used In The Chegg Com

No comments for "Cardco Inc Has an Annual Accounting Period"

Post a Comment